Introduction

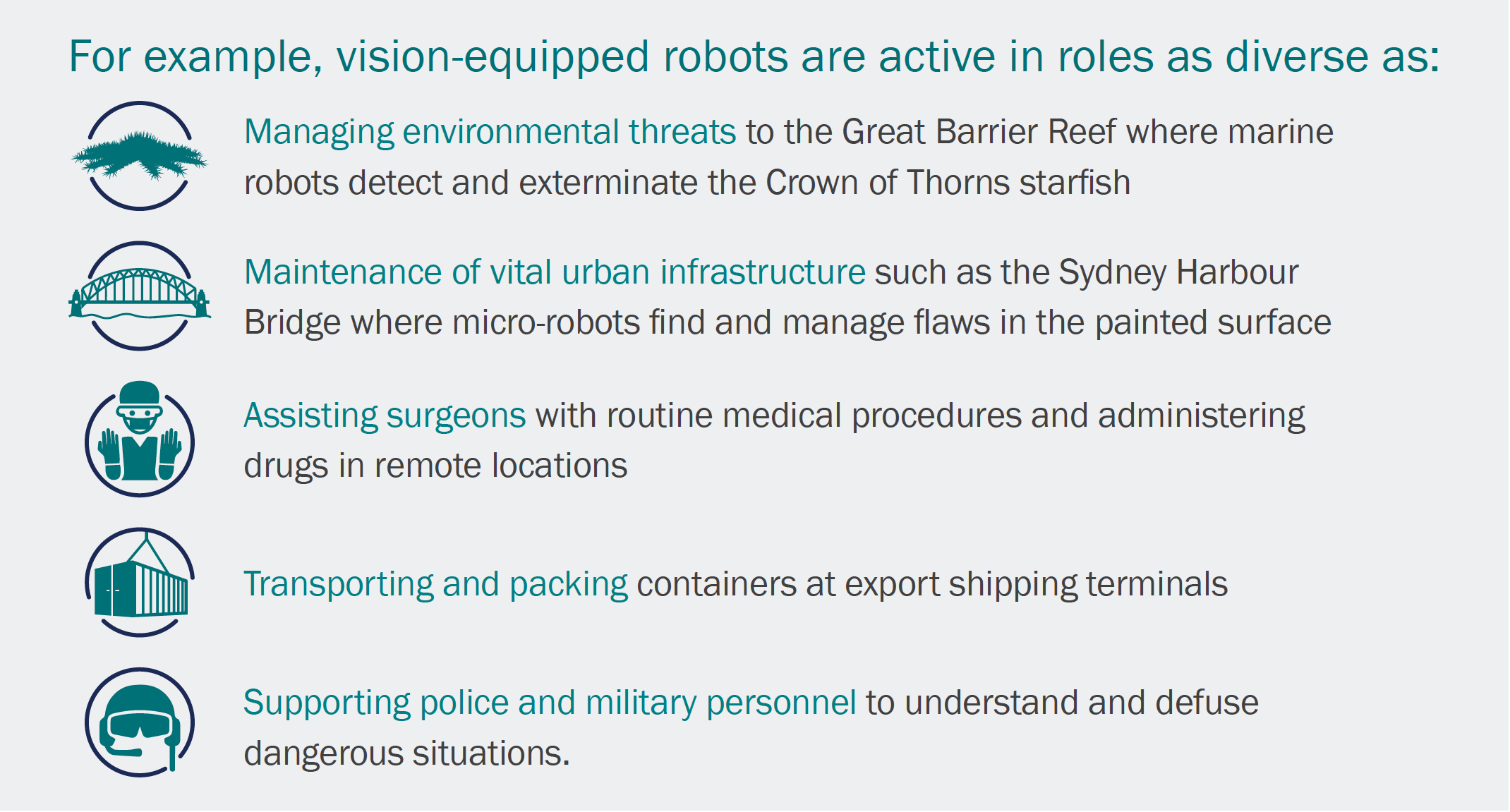

The Australian robotics industry is diverse, existing as either service businesses within major corporations or small-medium sized enterprises meeting niche market needs. The industry is supported by technological expertise across the university sector (such as the Australian Centre for Robotic Vision) and by the federal government’s independent agency, the Commonwealth Scientific and Industrial Research Organisation (CSIRO). Much of Australia’s industrial robotic activity is beyond plain sight but its role is vital.

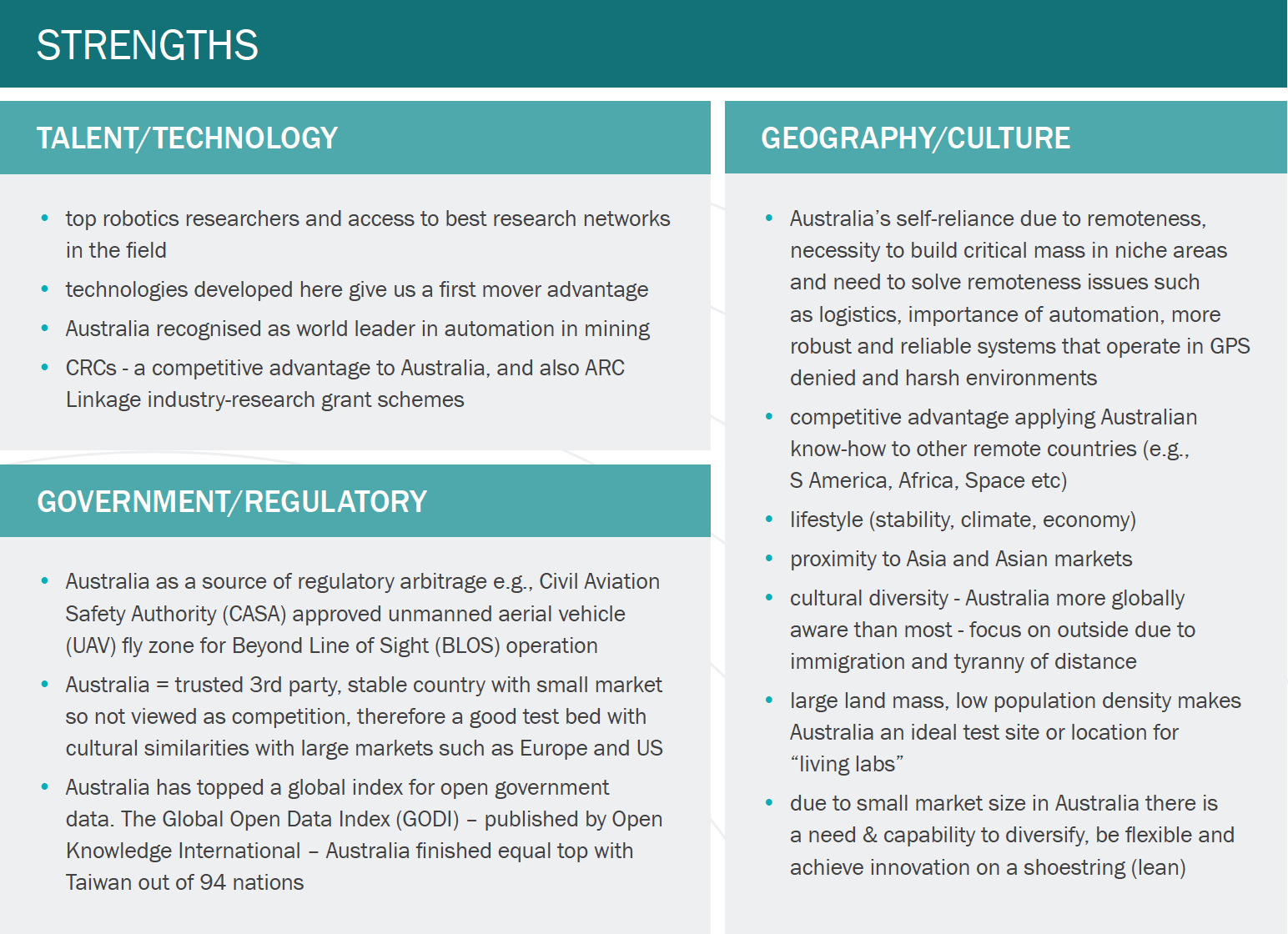

An analysis of the strengths, weaknesses, opportunities and threats (SWOT) for the Australian robotics industry was conducted at a roadmap writing workshop involving most co-chairs. Key strengths that emerged were:

- The current advantage Australia has in niche aspects of robotics in both talent and technologies.

- How Australia’s unique geography (such as vast distances and remoteness) has benefitted the development of world-leading field robotics applications.

- That many of Australia’s regulatory regimes are exemplars for the rest of the world.

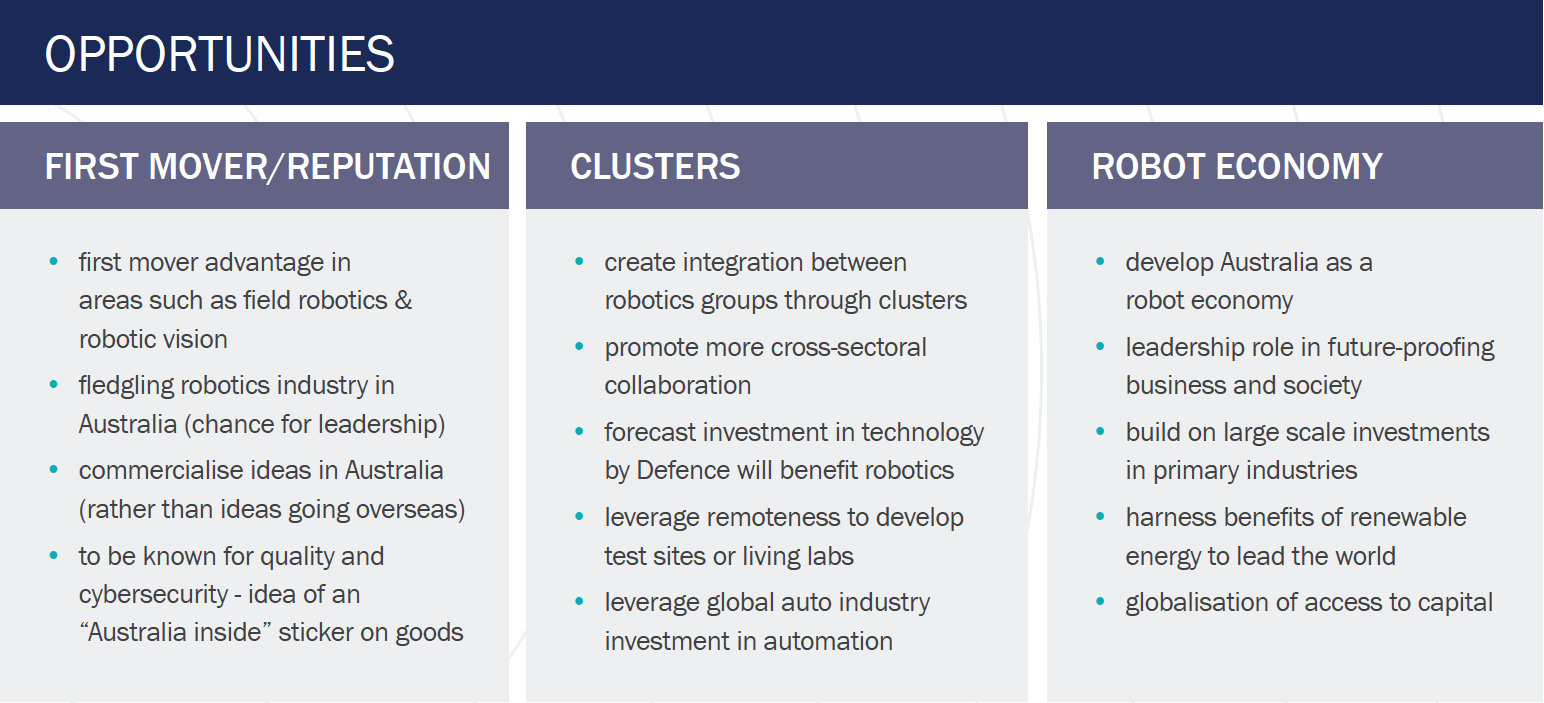

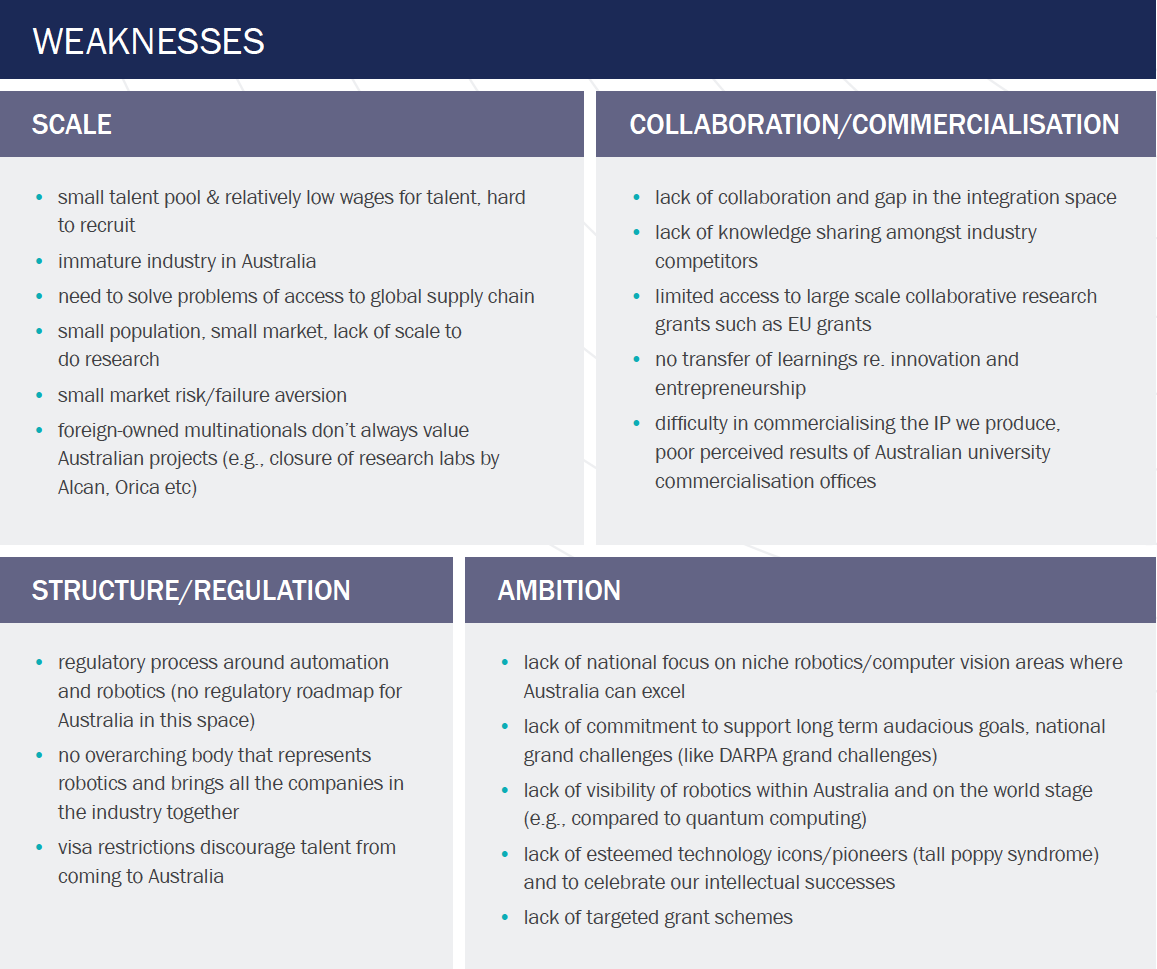

The Australian robotics industry has an opportunity to exploit these strengths by developing Australia as a test bed for new technologies and by further supporting the niche talent and technologies that currently exist. Capitalising on Australia’s first mover advantage in many areas will enable services to continue developing a strong robotic economy to benefit Australia in the future. The risk of not doing so may see the industry fall prey to weaknesses and threats, where Australia loses niche capabilities, talent and technologies to other nations. A failure to address the current challenges that are seen to be holding Australia back including collaboration, technology commercialisation, and structural changes to support a robot economy, may indicate that Australia lacks the ambition to succeed in the new high tech industries of the future.

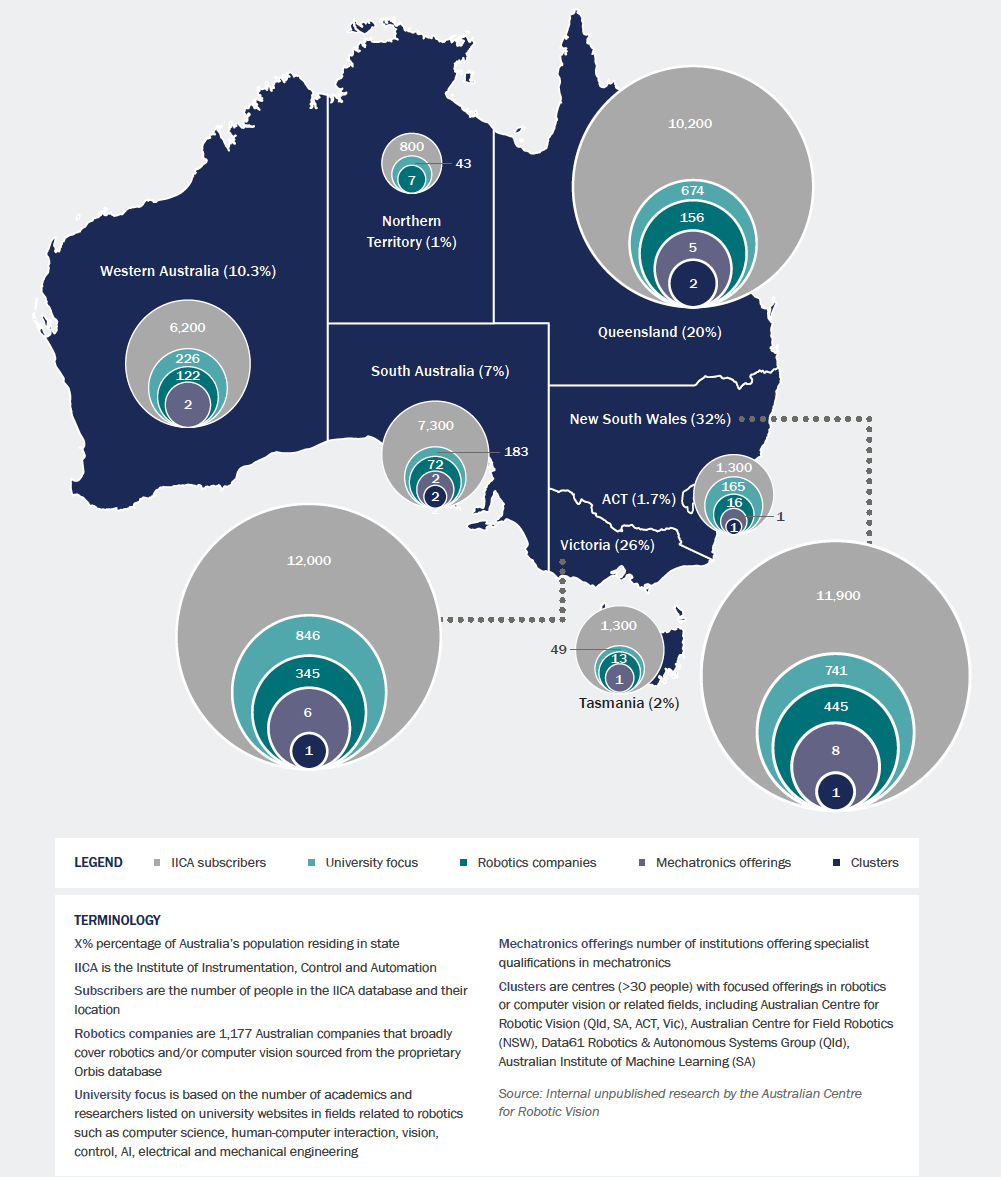

Defining Australia’s robotics capability on a state-by-state basis shows that robotic capabilities closely match the population estimates, with the most populous states having the highest number of robotic companies and highest levels of robotic capability. Notable exceptions being:

- South Australia, which has a high number of Institute of Instrumentation Control and Automation (IICA) subscribers relative to population size, due to its manufacturing expertise.

- Australian Capital Territory (ACT), which has a high university focus relative to population size, due to the size of its tertiary education sector.

- New South Wales (NSW), which although the state hosts a high number of robotic companies, ranks lower in university focus and IICA subscribers than might be expected.

A web-based survey by the Australian Centre for Robotic Vision identified more than 1,100 companies within Australia that broadly encompass activities in robotics (see Capability map). Advances in robotics mean these companies, and others that emerge, will be important to Australia’s robotic industry and will support future productivity growth and employment in Australia. Publicly available data suggests that 442 of these “robotic” companies employ almost 50,000 Australians and generate more than $AU12b revenue each year.

The identified companies cross a range of sectors including manufacturing, services, healthcare, resources, infrastructure, agriculture, the environment, space, and defence. Each of the representative sectors, their current use and the potential future uses of robotics, are explored in more detail in the body of this roadmap.

The ability to maximise the benefit of the robotics industry within Australia is approaching a crossroads, where choices must be made about the scale and direction of public and private investment. Public investment in robotics occurs through the universities system and major public sector users. Understanding the barriers and incentives to investing in the start-up arena, which houses much of the talent and fosters innovation in the technology sector, is essential. Decisions about the future of the robotics industry in Australia do not occur in isolation however, and a scan of the Australian landscape needs to be considered in the context of peer and competitor nations.